It’s easy to scroll through social media and believe investors are driving up home prices…

What the Housing Market Forecast Says About the Rest of 2025

We’re already past the halfway mark of 2025, and if you’ve been watching the housing market, you’ve probably noticed it feels different than it did a year or two ago. So, what can buyers and sellers expect heading into the rest of the year?

Here’s what the latest expert forecasts suggest for home prices, mortgage rates, and what it all means for your next move.

🏠 Will Home Prices Drop?

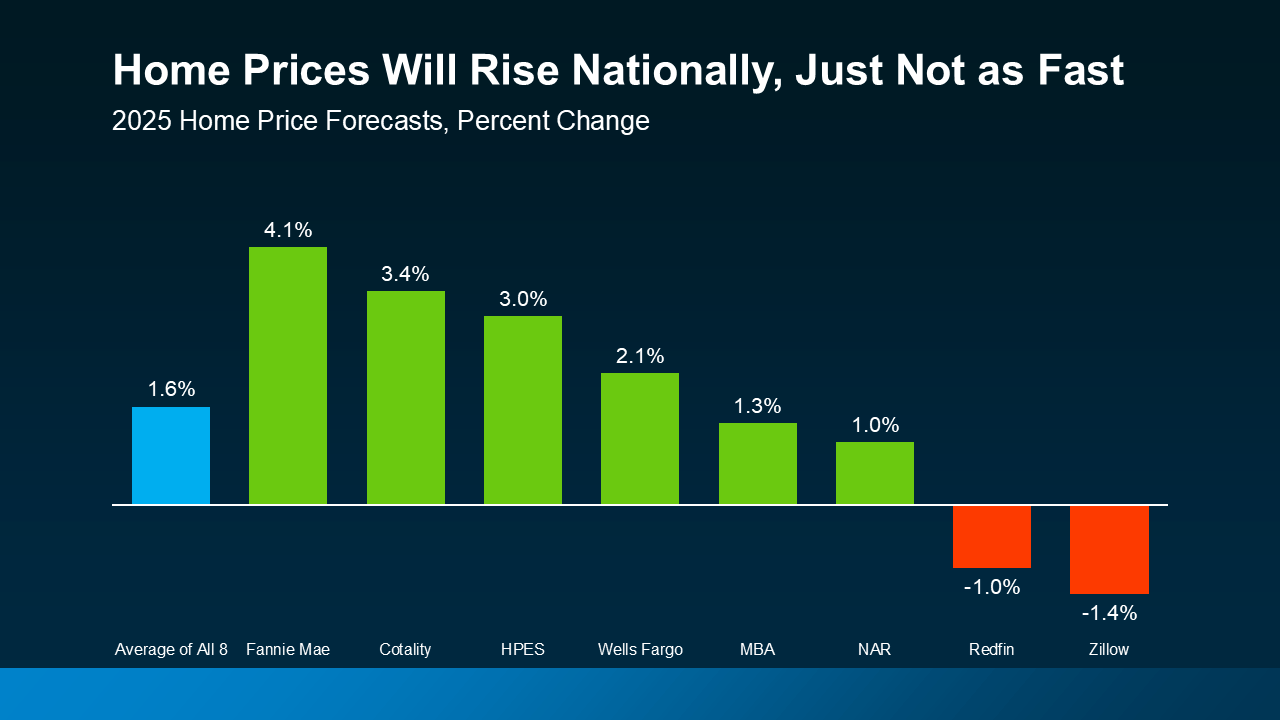

Let’s address the elephant in the room—no, home prices are not expected to crash.

While some headlines talk about price drops in a few areas, the overall trend is one of slower growth, not decline. As the National Association of Home Builders (NAHB) explains:

“House price growth slowed, partly due to a decline in demand and an increase in supply… These factors signaled a cooling market, following rapid gains seen in previous years.”

That’s a good thing. After several years of sharp appreciation, we’re seeing more balance. But here’s what matters—prices are still projected to rise.

The average forecast from eight leading analysts shows home values increasing 1.5% to 2% nationwide in 2025.

Even in markets where prices have softened slightly, the dips are modest—on average, just around 3.5%. That’s a far cry from the 20%+ drops during the 2008 crash. Plus, let’s not forget home prices are up over 55% nationally compared to five years ago, according to the FHFA.

The bottom line? Prices aren’t falling, and waiting for a major correction could cost you time and opportunity.

💸 Will Mortgage Rates Improve?

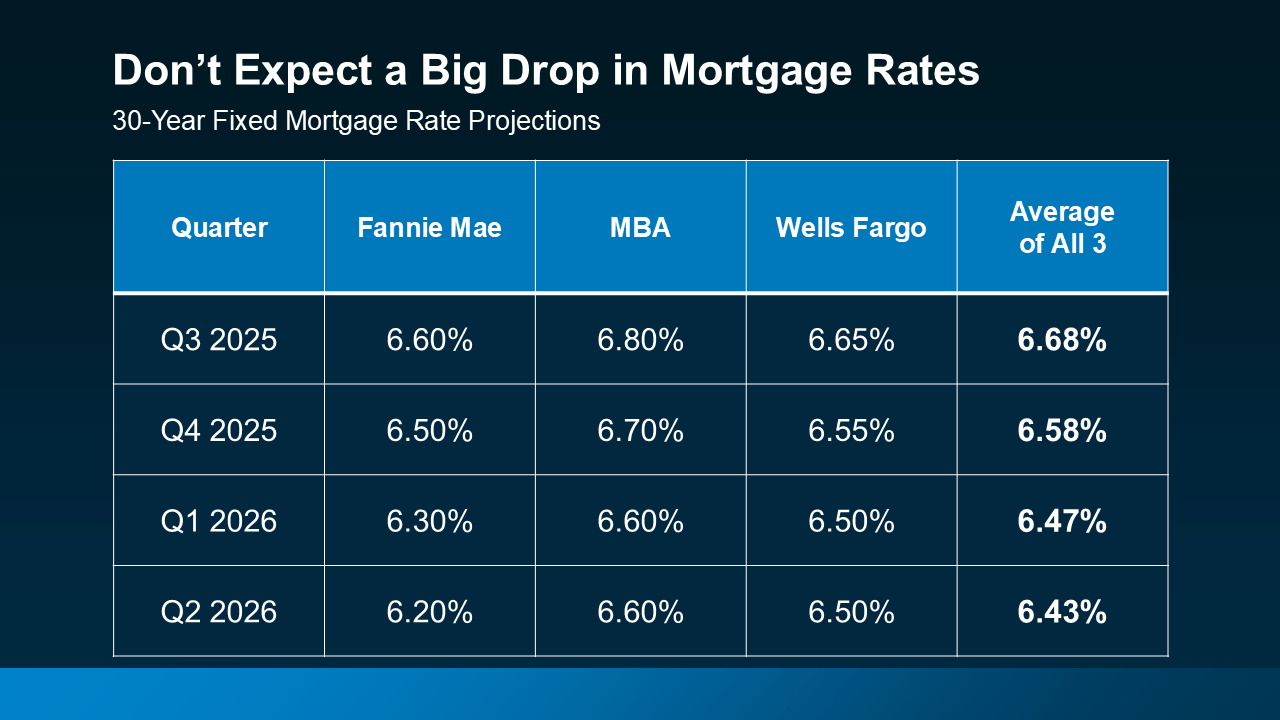

Many buyers are still on the sidelines waiting for rates to drop—but the experts are saying, don’t hold your breath.

Yahoo Finance recently reported:

“If you’re looking for a substantial interest rate drop in 2025, you’ll likely be left waiting.”

Most projections expect mortgage rates to stay in the mid-6% range for the rest of the year, which is roughly where we are now. There’s no major dip coming, at least not based on current economic indicators.

That doesn’t mean you’re stuck. It means we plan smarter.

Waiting too long could backfire if home prices rise or if the market gets more competitive. The better approach? Buy when it makes sense for your life, and focus on the total cost—not just the interest rate.

🧠 Strategy Over Headlines

The housing market in 2025 isn’t crashing. It’s moderating.

Prices are still rising—just at a slower pace. Rates are expected to remain steady. And that means buying or selling right now comes down to your personal situation, not market timing.

Trying to guess what the Fed will do next or waiting for a mythical “perfect” rate can lead to missed opportunities. Your best move is to work with a mortgage pro who knows how to navigate today’s market with clarity and confidence.

📍 Local Insight: What’s Happening in Southern California?

In areas like Garden Grove, Anaheim, Huntington Beach, Torrance, and Long Beach, prices are holding strong and listings are ticking up slightly, giving buyers more choices than they had last year. While we’re not in a full-blown buyer’s market, we’re seeing more balanced conditions, especially in entry-level and move-up segments.

Mortgage rates are still influencing buying power, but serious buyers are moving forward—and locking in today’s rates with a plan to refinance if and when rates fall.

If you’re considering a move in SoCal, now is the time to get clear on your numbers and options. The market isn’t stalling, and neither should your plans.

✅ Bottom Line

Housing experts expect moderate price growth and steady mortgage rates through the rest of 2025. No crash. No big dip. Just a more balanced market that requires a clear strategy over speculation.

📲 If you’re ready to explore your options, let’s connect and talk through what makes the most sense based on your goals, budget, and timeline.