The VA home loan advantage gives Veterans and active-duty service members access to one of…

The Real Reason Homes Feel So Expensive (Hint: It’s Not Wall Street)

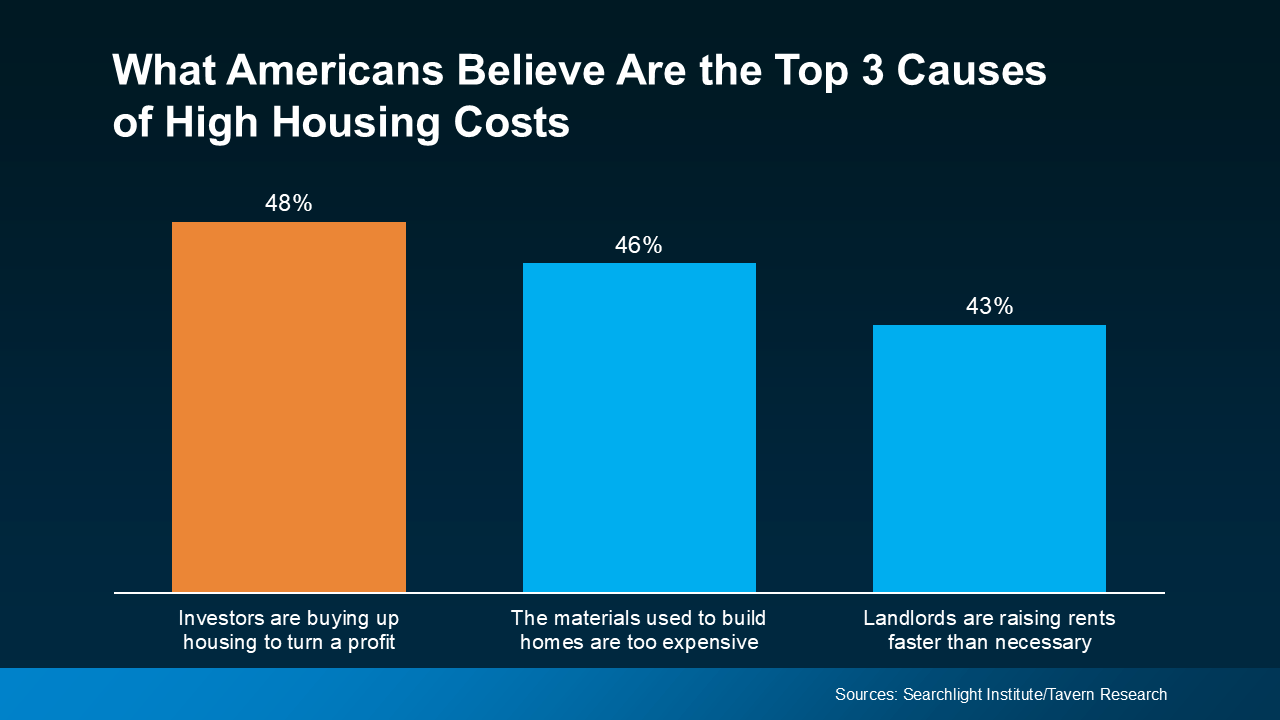

It’s easy to scroll through social media and believe investors are driving up home prices. A recent national survey found nearly half of Americans (48%) think big investors are to blame for why housing feels so unaffordable.

But here’s the thing — the data tells a different story.

The Truth About Investors

Yes, investors play a role in certain markets, but they aren’t buying up every available home like the headlines suggest. Realtor.com found that in 2024, only 2.8% of all home purchases were made by large investors (those owning 50+ properties). That means roughly 97% of homes were bought and sold by everyday people, not corporate giants.

As Danielle Hale, Chief Economist at Realtor.com, explains:

“Investors do own significant shares of the housing stock in some neighborhoods, but nationwide, the share of investor-owned housing is not a major concern.”

So if it’s not investors, what’s really driving prices higher?

The Real Issue: Not Enough Homes

According to Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB):

“It’s been popular among some to blame investors, but with housing, the economics of that don’t make a lot of sense. The fundamental driver of housing costs is the shortage itself—it’s driven by the mismatch between the number of households and the actual size of the housing stock.”

In short, we simply don’t have enough homes for the number of buyers out there. That lack of supply has kept prices elevated across much of the country, including here in Southern California.

📉 Why This Matters for Buyers

As more homes finally hit the market, buyers could start to see a shift. More inventory means more choices, potentially fewer bidding wars, and a better balance between buyers and sellers.

If you’ve been waiting for the right time to buy, it may be closer than you think.

📍 Local Insight: What This Means in Southern California

-

Long Beach & Seal Beach: Coastal markets remain strong, but new listings are slowly increasing, especially for condos and smaller single-family homes.

-

Costa Mesa & Huntington Beach: Move-up buyers are creating more turnover, giving first-time buyers slightly more opportunities than we saw last spring.

-

Irvine & Lakewood: Inventory growth is modest but trending upward — good news for anyone feeling squeezed by limited options.

💡 Bottom Line

It’s easy to blame investors for today’s high home prices, but the real issue is simple — we need more homes. As supply improves, affordability and opportunity should gradually follow.

Let’s connect to talk about how this shift could impact your next move in the local market.